Corporate Governance

Basic Policies

At Unitika Group, we carry out business activities as we strive to be a company that is continuously chosen by customers, under our philosophy of contributing to society by connecting people’s lives and technology. We have worked to achieve stakeholder-focused management by pursuing stakeholder strategies that include the enhancement of legal compliance and risk management, the timely and appropriate disclosure of information, and the implementation of rapid decision making. We believe this will enable Unitika to maximize corporate value in an increasingly global environment, and continue to grow.

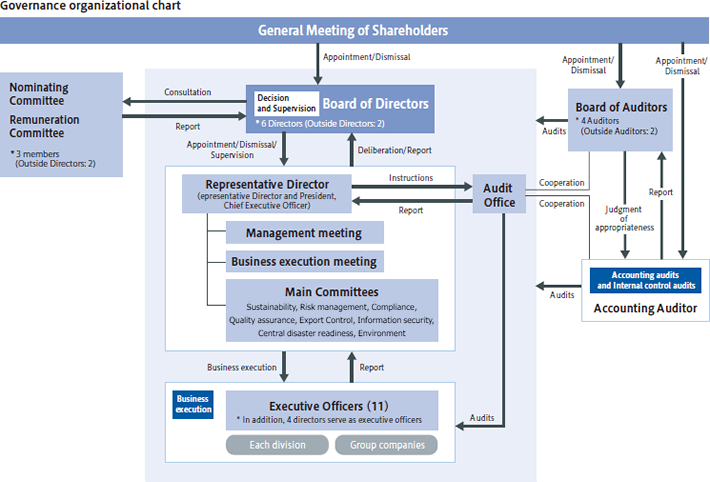

Structural Overview

Under the Companies Act, Unitika has adopted the system of a company with a Board of Auditors, and put in place auditors. We have also introduced a voluntary executive officer system. We divide the decision making and management supervisory (governance) functions of the Board of Directors and the business execution functions of the executive officers. In order to enhance the mobility and effectiveness of the management, we promote cooperation between the directors and the executive officers, while most of the directors also serve as the executive officers with some exceptions.

We believe that our governance system is functioning as expected by means of the establishment of a voluntary committee, an executive officer system, outside directors, and an auditor system.

Board of Directors

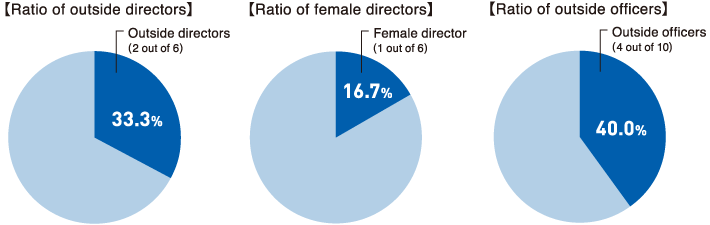

The Unitika Board of Directors is composed of six directors: Representative Director and President Shuji Ueno (chairman), Masakazu Kitano, Katsuhide Kyunai, Tsunetoshi Matsuda, Minoru Furukawa (outside director), Noriko Ishikawa (outside director). The outside directors apply their respective extensive experience and broad knowledge to provide objective recommendations; this enhances the transparency and integrity of management. In addition, Unitika has established criteria for independence and ensures independence by appointing directors in accordance with these criteria.

The auditors (Shigeru Sugisawa, Akio Toyoda, Tetsuaki Fukuhara (outside auditor), Makoto Sano (outside auditor)) attend the Board of Directors meetings so that they can speak up and check the decision-making process of management. The Board of Directors meetings are held once a month, and also on an ad-hoc basis as required.

Board of Directors

Skills Matrix

| Name | Position in the Company |

Type | Gender | Skills and experience | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate management Management planning |

Sales Marketing |

Finance Accounting |

Legal affairs Risk management |

R&D Manufacturing |

Global | Sustainability Human resources and personnel development |

||||||||

| Shuji Ueno |

Representative Director and President, Chief Executive Officer |

Representative Director and President, Chief Executive Officer | Male | Male | Skills and experience | ● | ● | ● | ||||||

| Masakazu Kitano |

Director, Managing Executive Officer |

Director, Managing Executive Officer | Male | Male | Skills and experience | ● | ● | |||||||

| Katsuhide Kyunai |

Director, Managing Executive Officer |

Director, Managing Executive Officer | Male | Male | Skills and experience | ● | ● | ● | ||||||

| Tsunetoshi Matsuda |

Director, Senior Executive Officer |

Director, Senior Executive Officer | Male | Male | Skills and experience | ● | ● | ● | ||||||

| Minoru Furukawa |

Director | Director | Outside, Independent |

Outside, Independent | Male | Male | Skills and experience | ● | ● | ● | ||||

| Noriko Ishikawa |

Director | Director | Outside, Independent |

Outside, Independent | Female | Female | Skills and experience | ● | ||||||

(Note) The table listed above is not a comprehensive listing of the full range of knowledge and experience the directors have.

Board of Auditors

The Unitika Board of Auditors is composed of four auditors: Shigeru Sugisawa (chairman), Akio Toyoda, Tetsuaki Fukuhara (outside auditor), and Makoto Sano (outside auditor). These auditors audit and monitor management, such as the management policies, execution of business operations, and preservation of property in accordance with standards including the relevant laws and regulations, the Unitika Articles of Incorporation, and provisions, etc.

Nominating Committee / Remuneration Committee

The Unitika Nominating Committee and Remuneration Committee are each composed of three directors: Minoru Furukawa (outside director) as Committee Chairman, Shuji Ueno, and Noriko Ishikawa (outside director). These committees deliberate matters concerning the appointment and remuneration of management (executive officers) and the nomination of candidates for directors and auditors, and then report their recommendations to the Board of Directors (for auditor candidates, after approval from the Board of Auditors). This is how these committees are working to ensure the integrity and improve the transparency of matters related to executive officers and determining their remuneration.

| Meeting | Number of times held |

|---|---|

| Board of Directors | 16 |

| Board of Auditors | 13 |

| Nominating Committee | 3 |

| Remuneration Committee | 5 |

| Rate of attendance of outside directors at the Board of Directors meeting | 94% |

| Rate of attendance of outside auditors at the Board of Directors meeting | 100% |

| Rate of attendance of outside auditors at the Board of Auditors meeting | 100% |

Evaluating the Effectiveness of the Board of Directors

Unitika conducts self-evaluation and analysis of the effectiveness of the Board of Directors with the aim of improving the functioning of the Board of Directors and thereby enhancing corporate value.

For self-assessment and analysis, the following methods were used with the advice of external organizations.

In March 2024, Unitika conducted a survey on all directors and auditors comprising the Board of Directors. We were able to ensure the anonymity of the respondents by having them submit their answers directly to the external institutions. At the regular Board of Directors meeting held in June 2024, we analyzed, discussed and evaluated the Board of Directors, taking into consideration the tallied results from the external institutions.

The results were generally a positive evaluation of the support system, composition, operation, management, supervision, and other functions of the Board of Directors. Subsequently, we have evaluated the Board of Directors to be effective overall.

In the previous evaluation of effectiveness, there was a shared recognition that the Board needed to make the meetings a forum for lively discussions on management issues and strengthened management monitoring functions, since then, we have seen steady progress in efforts to address these issues, such as initiatives for the promotion of diversity as a management issue, as well as following up on management plans and implementing risk management.

There were views expressed on the ongoing strengthening of monitoring function of management and a shift to making the meetings a forum for lively discussions on management issues of the Board of Directors. Opinions were also shared on issues concerning the further enhancement of the Board of Directors’ functions.

Remuneration of Executive Officers

All Unitika executive officers are remunerated in cash payments. Excluding outside directors and auditors, these payments to executive officers are comprised of position-specific fixed remuneration and performance-linked remuneration as an incentive. Outside directors and auditors only receive fixed remuneration.

The remuneration of Unitika executive officers is determined via consultation with the voluntary Remuneration Committee, which has an independent outside director as the Committee Chairman and is set up as an advisory institution of the Board of Directors. The remuneration of directors is determined by the Board of Directors, and the remuneration of auditors is determined by the Board of Auditors. When determining the level of remuneration for executive officers, we also refer to surveys and other data from external third-party institutions, and take into consideration the views, etc. of outside officers in the Remuneration Committee. The remuneration is appropriately determined within the maximum limit of executive officer remuneration (within 40 million yen per month for directors and within 6 million yen per month for auditors), as stipulated at the Annual General Meeting of Shareholders (June 28, 1990).

Unitika’s performance-linked remuneration system targets achieving the medium-term management plan as a strong motivator. It was introduced for executive officers excluding outside directors and auditors, and calculates remuneration based on an evaluation of the achievement rate according to the current fiscal year’s results for the medium-term management plan’s revenue target values. The ratio of performance-linked remuneration has been roughly set at around 10% of the position-specific fixed remuneration as a standard level. The evaluation of the achievement rate related to the revenue that is the base for calculating the remuneration is set using a certain weight assigned to consolidated net sales, operating profit, and net profit. Also, the evaluation for calculating the performance-linked remuneration is determined via consultation with the Remuneration Committee.

| Category of executive officerss | Total (million yen) |

Class-specific total (million yen) | |

|---|---|---|---|

| Fixed remuneration |

Performance-linked remuneration |

||

| Directors (excluding outside directors): 5 | 107 | 107 | - |

| Auditors (excluding outside auditors): 3 | 27 | 27 | - |

| Outside officers: 5 | 33 | 33 | - |

(Note) The above figures include two directors and two auditors who retired upon the conclusion of the 213th Annual General Meeting of Shareholders held on June 29, 2023.

Internal Control System

Basic Policies

Under the Companies Act, Ordinance for Enforcement of the Companies Act and Financial Instruments and Exchange Act, Unitika has created a system that ensures the adequate operation of our company and group, as well as the trustworthiness of our financial reports, as follows.

Structural Overview

The Internal Control System stipulates the Unitika’s Basic Policy for Internal Control based on Companies Act and the Financial Instruments and Exchange Act. Internal controls for financial reporting are dealt with mainly at the Audit Office, while internal controls regarding offices are set up at our key business branches in order to establish the corporate framework for internal controls. Also, in addition to collecting information within the company and the Group, which is mainly done by the Risk Management Group, we also have systems in place to enable a timely response to matters, including setting up a Compliance Committee and whistleblower contact points within and outside the company.